40 Aesthetic Dining Rooms: Tips & Inspiration

Like Architecture and Interior Design? Follow us …

Thank you. You have been subscribed.

![]()

Dining rooms are special places where treasured memories are made. They are the place where we gather with all our family and close friends to break bread and celebrate the most special occasions and annual holidays. They are the place where birthday wishes are made on the glow of cake candles and where hearts are healed over a hot cup of tea. Dining rooms deserve our proper attention and yet they are often brushed compared to living rooms and kitchens. This collection of 40 aesthetic dining rooms aims to inspire dining rooms that will honor every family meal time and every important occasion.

Did you like this article?

Share it on any of the following social media below to give us your voice. Your comments help us improve.

For more information on the real estate sector of the country, keep reading Feeta Blog.

40 Aesthetic Dining Rooms: Tips & Inspiration

All About Property Mutation in Pakistan

Property Mutation, Once you have completed all the formalities of a real estate transaction, the next and final step is to register the said property under your name to make it official in government records. This is known as the mutation of a property. It refers to the entire process in which the title of ownership of a property is transferred to another person. Simply put, it is the title deed (also called a conveyance deed) needed to have the property under your name.

Feeta.pk has compiled all the basic details that you need to know regarding the property mutation process.

When do you need a mutation certificate?

- When you buy a property

- When you inherit a property

- When you receive a property as a gift

- When you purchase a property through a power of attorney

How do you apply for a mutation certificate?

Since obtaining the mutation certificate is not a legal obligation, many new property owners postpone the process. However, the mutation process should ideally be started as soon as possible once the property has changed hands – at least within 3-6 months of the land purchase. Without it, the buyer may risk facing issues in obtaining complete legal ownership of the property in question.

The process just comprises a few, simple steps:

- Visit the land administrator’s office in the concerned area (where the property is located) and submit the required documents. These may also vary according to circumstances. For example, if this is a mutation of the property after the owner’s death, applicants would have to submit a death certificate, succession certificate, etc. You can cross-check on the government website or call on the helpline for further information, but you would still have to visit the municipal body to hand in the papers.

- Both the seller and buyer have to appear with two witnesses and the sub-registrar will hear their verbal agreement for trading the property.

- This will be recorded in the Inteqal (Mutation) Register, and you will be handed a receipt.

- Afterward, you would have to submit a nominal process fee to the National Bank of Pakistan (this will be just a one-time charge).

- There will be a physical verification of the site by the relevant authorities.

- The municipal body may take up to a month to update the record, after which they would issue the mutation certificate.

Why is it important to get a mutation certificate?

Even though it is not a legally binding document, the mutation certificate is still necessary for several reasons:

- It serves as additional proof of ownership.

- You will be able to record the property under your name in the municipal local body.

- It can also be required when applying for utilities, such as electricity and water services.

- It may also serve as a tax record.

- You would need it if you want to sell or transfer your property to someone else in the future. If you are unable to produce a mutation certificate before potential buyers for verifying the chain of ownership, you may risk the sale of your asset.

- In case of land dispute, corruption or hostile takeovers, the mutation certificate can help challenge false claims in court.

- All immovable assets (individual homes, apartments, land, etc.) are subject to property tax payment, and mutation is just a way to ensure that. The certificate is required by the government to fix the property tax liability and other levies on the rightful owner.

- It can also help you correct any errors in the records in case there is an unauthorized transaction.

What is the difference between registration and mutation?

There is some ambiguity over the difference between property registration and mutation since the purpose of both seems similar. Property registration refers to the process in which you claim legal rights on a property by registering the sale under your name. The process of mutation, on the other hand, is the buyer’s responsibility and can only be initiated once the property registration has been executed.

| Property Registration | Property Mutation |

| Also called a baye-nama | Also called inteqal |

| Mandatory process after transfer of property | Not a legally required process after the transfer of property |

| Legalizes the actual sale of a property | Transfers ownership of the property |

| A sale deed | Does not require a sale to take place; it applies to inherited and gifted properties too |

While the key differences between the two are just a few, it is still important to know the significance of each to avoid any potential problems or confusion in the future if you choose to resell the property. This is why it is advised to acquire both in the beginning.

If you are looking for more information on the real estate processes in Pakistan, you can visit this link.

All About Property Mutation in Pakistan

The Ultimate Guide to Selling Property in Pakistan

Selling and Transferring Property in Pakistan is a regular occurrence in the country, where hundreds and thousands of people sell and transfer property. For those familiar with the process, the transferring procedure might just be a piece of cake. But for people who are new and confused about where to start, you’ve come to the right place.

Before we jump into the tricky aspect of this process, let’s clear the air about what exactly transferring property means and why it is an essential aspect of buying and selling property in Pakistan.

What do we mean by transferring property?

As per the law, any individual who owns a property should have the land or property verified under their name. The land should be under the designated ownership; only then can they sell the property to themselves. This is the basic requirement of selling a property.

In Pakistan, the transfer of any property generally consists of the owner transferring the title of the land from one person to the other. Transferring property can occur in multiple ways for various reasons, such as a mortgage, gift deed, inheritance, lease, exchange, etc. All such explanations are why transferring is an essential legal procedure.

Who is eligible to transfer property?

All individuals who can sign a contract are authorized to transfer property ownership in Pakistan. According to the Contract Act 1872, a contract is claimed as a binding agreement between two parties, meaning that it is a legally binding document for any sale and purchase of land in the country.

There are a few exceptions for people who are not eligible to transfer a property:

- Minor: Anyone under the age of 18 is a minor and therefore cannot carry out the process.

- Unstable Individuals: Someone who cannot understand the consequences of their actions, for instance, that of a mentally ill person. Other reasons can be permanent or temporary physical disability such as a Coma etc.

- Legally Barred Individuals: Someone barred from signing contracts cannot transfer property in Pakistan.

What are the steps involved in transferring and Selling a property in Pakistan?

The transferring process, although time-taking, is a simple and easy process with not many legal proceedings. We’ll break down the process into different steps to help you better understand.

Token (Bayaana)

This is the very first step of selling after you’ve successfully secured a client. This involves the buyer giving approximately 1 / 4th of the total price. If not the exact percentage, there is an agreed amount between the buyer and the seller to indicate an agreement from both sides of the party.

The Token (Bayaana) is given by the buyer with a series of negotiations and based on a contract, in which all details are specified. After this, the seller holds negotiations with any other potential buyers.

Usually, a specified period is set and written in the contract for the full amount to be paid. If the sale falls through, the token is returned. But if the full amount is not paid in the specified time, the seller has no obligation to return the token, even if the sale doesn’t go through.

What is a Property Sale Agreement and how can we get it?

A sale agreement contract is a set of required documents that include all information related to the seller and buyer involved in the transfer process. In Pakistan, these are the required documents that are attached with the Bayaana form:

- Complete details of the property with the property owner’s verified name

- Terms of sale for the property

- The total amount of money which the property is being sold for

- Final date for the buyer to pay the remaining sum of money

What is the complete list of documents required?

To carry out the transfer process smoothly, you need to collect the following documents organized. You’ll need:

- Recent Passport Photos of both parties involved (Buyer and Seller)

- Photocopies of National Identity Cards of both parties

- Original Purchase Deed of the Seller (From the time they purchased the property)

- The original ‘Sale deed’ which is the agreement contract between both parties

This list of documents can also include some more documents depending on the province, region, area, etc. (A lot of documents, we know, but verified property takes tough measures!)

- A ‘Record of Rights’ also known as Fard-e-Malkiat, is a form that can be obtained by the seller from the property registration office. This guarantees that the property is under the name of the seller.

- You’ll need a Non-Demand Certificate (NDC), a document that shows you don’t have any fine due on the property. Depending on the location, you can get this from the local development authority’s office.

- For properties in private housing schemes, there is the need to request a letter from a particular society to carry out the property transfer. This can be used in place of the Fard-e-Malkiat document.

Possession of Stamp Paper and Tax Payment

Source: Pinterest

This is one of the essential and final steps of the transfer process. You’ll need a stamp paper to draft the deed for the sales; that will be the contract for the sale. You can choose. Buyers; will be required to pay stamp duty and taxes during this step.

Let’s take a look at this easy breakdown of the tax duty involved:

- Stamp Duty 3%

- Capital Value Tax 2%

- District Council Fee 1%

- Fixed Registration Fee PKR500 (Can differ as per govt. Order)

Drafting the Sales Deed

In Pakistan, the sales deed is usually recommended to be drafted by a property lawyer or a property agent aware of the bylaws and the rules involved in the process. This is a particularly safe option to avoid any complications that might arise in case you are doing it yourself.

Although, people who are selling and buying property as a business have become familiar with constructing the ideal draft for this deed, which can be done easily with the help of the internet. However, the common practice and recommendation are to take the help of a lawyer to avoid any future complications that may occur.

What do we do after drafting the Sale Deed?

Source: Freepik

Finally, after a long process, you’ve reached the last step. You can take the sales deed (inscribed stamp paper) along with the required documents to the registrar’s office. From here, the sub-registrar will call both parties simultaneously and hear their verbal agreement for the trading of property.

You’ll need to sign the documents and put in your fingerprint to verify the final sale and complete the transfer process. Once this is done, the official will register the sale deed successfully, then the transfer process is complete, and the property is now successfully transferred to the buyer.

How much is the Commission for the Property Dealer Involved?

If you’re wondering what the person who helped you secure a client and help you proceed with the sale and transfer of the property is, there is a commission that the dealer/agent gets from the client. Although there are no specific laws to govern and record the work of real estate agents and dealers in Pakistan, the general practice remains a constantly changing variable and experiences changes from time to time.

Usually, the commission of property agents comes to around 1% of the total value of a property. This 1% of the value is each from the buyer and seller as the commission to the dealer. If the buyer and seller both have different agents, then both agents get to keep a 1% commission each from their own clients. Sometimes, property agents will ask for as high as 2% of the property value, or even lower than 1%. The amount varied according to the success, reputation of a property dealer, or property value.

Suppose you’re looking to learn more about the legal aspects and procedures involved in property buying and selling. In that case, you can stay connected with our blogs at Feeta.pk, where you can easily find comprehensive information to guide you through the real estate market.

The Ultimate Guide to Selling Property in Pakistan

- Published in Housing Schemes, Infrastructure, International, Property Business In Pakistan, Property Consultant, Property In Pakistan, Property Laws, Property News, property sell in pakistan, property selling, Real Estate, real estate business, real estate buyer sales, real estate financing, real estate goals, Real Estate Guide, real estate investing, real estate investment, Real Estate Investments, real estate market, Real Estate News, Real Estate Trends, USA

Things you need to know about House Flipping

House flipping is one of the most common ways to earn money through real estate in Pakistan. If you have ever seen people who buy properties that are almost in ruins and, after a series of renovations, turn them into spectacular homes that later make good profits when they sell them, and you wonder how they do it, you are at the right place.

This blog brings you things you need to know about house flipping. To learn more about house flipping in Pakistan, keep on reading.

What is house flipping?

Flipping is a quick profit strategy in which an investor purchases real estate at a discounted price and then improves the property to unload it at a better price. Instead of buying a property to live in, the person buys a house as a real estate investment.

It is worth mentioning that the primary purpose of flipping is to buy low and sell high. In short, flipping, also known as grand real estate investing is a type of real estate investment strategy in which an investor buys a property not to use it but to sell it for profit.

How do investors make money through property flipping?

This gain generally stems from a price appreciation arising from a hot real estate market in which prices are rising rapidly or from capital improvements made to the property, or both. For example, an investor could purchase a property in a “warm” neighborhood, do significant renovations, and then offer it a price that reflects its new look and amenities.

Currently, in the absence of inventory, tearing down and rebuilding houses can be an extremely lucrative strategic investment form in the face of a poor housing market. Older homes are usually at low prices and favorable mortgage rates allow borrowers to purchase the property with ease.

Things you need to know about house flipping:

Following are some of the things that you need to consider before flipping property in Pakistan.

Consider your finances and associated costs:

Real estate requires capital. The first cost is the cost of acquiring a property. While interest on borrowed money is tax-deductible even after the Tax, it is not a 100% deduction. Every rupee spent on welfare is added to what you have to earn from the sale to cover costs.

Do extensive research on your financing options to find out which type of mortgage is best for you, and find a lender that offers low-interest rates. An easy way to research financing costs is to use a mortgage calculator, which allows you to compare the interest rates offered by different lenders.

Of course, paying cash for the property eliminates the interest cost, but even then, there are property holding costs and opportunity costs to immobilize your money. Renewal costs must also be taken into account. If you intend to repair the home and sell it for a profit, the sale price must exceed the combined cost of the acquisition, the cost of maintaining the property, and the cost of the renovations.

Even if you manage to overcome the financial hurdles of scaling a home don’t forget about capital gains taxes, which will reduce your earnings.

Time constraints:

It is time-consuming to renovate houses. It will take months to find and buy the right property. Once you own your home, you will need to spend time getting it fixed. If you have a day job, the time spent on demolition and construction can be a wasted afternoon and weekend. If you pay someone else to do the work, you will spend even more time than you would expect to monitor the activity, and the costs of paying others for profit will decrease.

Once the work is complete, you will need to schedule inspections to ensure the property meets applicable building codes before you can sell it. Otherwise, you will have to spend more time and money to give it up somewhat.

By showing it yourself to potential buyers, you can spend a lot of time traveling to and from the property and in meetings. If you use a real estate agent you will be owed a commission.

It may make more sense for many people to stick to a day job, where they can earn the same kind of money in a few weeks or months regularly, easily roll without risk, and with a consistent time commitment.

Skillset:

Professional builders and skilled professionals, such as carpenters and plumbers, often trade houses for income alongside their regular jobs. They have the knowledge, skills, and experience to find and organize a home. Some also have union jobs that provide unemployment checks throughout the winter while working on their side projects.

The real money in a house exchange comes from equity. If you’re handy with a hammer, enjoy laying rugs, and can hang drywall, roof a house, and install a kitchen sink, you have the skills to flip a house.

On the other hand, if you are unfamiliar with the instruments, you will have to pay a professional for restorations and repairs. And that will reduce the chances of you getting a substantial return on your investment.

Lack of information:

To be successful, you know how to choose the right property, in the right location, and at the right price. Even if you have a lifelong argument (putting a house together at, say, the closing of a song), it’s crucial to know which restaurants need to be done and which ones to skip.

You also need to understand the applicable tax and zoning laws and know when to cut your losses becomes, learn to find out before your project turns into a cash hole.

Not patient enough

Professionals take their time and stay on the right property. Newbies rush to buy the first house they see. They then hire the first contractor to make an offer to tackle the work they cannot do themselves. Professionals do the work themselves or rely on a network of predefined, trusted contractors.

Newcomers hire a real estate agent to help them sell the house. Professionals rely on the efforts of the “owner for sale” to minimize costs and maximize profits. Newcomers hope to go through the process, put on a coat of paint, and earn a fortune. Professionals understand that it takes some time to buy and sell homes and that profit margins are sometimes tight.

Inspect your new home:

Check the box or electrical circuit board, making sure that the labels next to each switch, such as kitchen, bathroom, living room, etc., are located correctly. Do this by removing or unplugging each switch (one by one) to find out which room in the house they belong to. You can also hire an electrician to check the state of the electrical box (panel or panel) and if it needs to be repaired or replaced with a new one.

Check your fire alarms and carbon monoxide detectors to see if they are working well, need batteries, or be replaced.

Contact utility companies:

When you get to your new home, you will want essential services, such as electricity, gas, water and sewerage, cable, Internet, and telephone. So contact those companies in advance to set the date of transfer of those services to your new address.

Update essential documents:

One month before moving in, update your driver’s license, vehicle registration, and voter registration card.

These are some of the things you know about house flipping. Flipping houses for a living is getting popular by leaps and bounds because house flipping profit is excellent.

Give these pointers a read and incorporate them into your next purchase. This blog is especially beneficial for people who want to know about property flipping and flip houses for beginners.

To know more about real estate trends, visit the Feeta blog.

Things you need to know about House Flipping

Real Estate Strategies for beginners

Real Estate Strategies, Suppose you want to join the real estate investment community to grow your assets and plan your future to live on income. In that case, you must first evaluate the different alternatives to participate in the sector. Some require a more significant investment of time or money than others and experience or knowledge about the industry. In this blog, we bring you a list of real estate strategies for beginners that they can use to excel in the real estate industry of Pakistan.

To know more about these strategies, keep reading.

Vacant spaces:

Vacant spaces, including land, are among the few assets in the world whose price appreciates over time. This type of investment gives value to areas of your property that are not occupied or of little use, such as guest rooms, parking lots, basements and ceilings. It works for both seasonal and long-term leases. It is ideal for beginning investors unfamiliar with market values or the practice of leasing entire properties.

In short, one of the best strategies to increase your real estate portfolio is by investing in vacant land.

Leases:

It is the most common earning mode. In this case, you buy a property to lease it, either in the short term (temporary or vacation) or long term (more than six months). You can focus on having multiple tenants for a property in different periods (winter or summer, vacations, holidays, AirBnB style) or opt for the traditional lease to a single person for a specified time.

Buying and selling:

In this strategy, your focus is on acquiring and reselling residential properties in areas of most significant demand, close to high-traffic public spaces (supermarkets, metro stations, bus stops). It requires you to study well the prospects before investing and the regulatory plans of the target zones.

Manage properties:

Under this strategy, you buy and lease properties and offer administration services, from paying everyday expenses to technical maintenance checks, such as plumbing and electricity.

Renewals:

In this strategy, you buy houses at a low price and need repairs; you completely renovate them and then sell them at a higher price. The challenge here is to manage knowledge and values of masonry, design and architecture work.

Real estate funds:

The investor invests in real estate indirectly through a private fund dedicated to buying or developing properties for sale or rent. The profits of the projects are distributed among the contributors of the fund as dividends. The industry initially began focusing on corporate buildings and offices, but later expanded into the housing sector.

Invest in auctions:

In this case, the investor acquires the real estate in an auction process with the sole purpose of reselling it later at a higher price. This type of investment is attractive because the property went through the bank first. Therefore the property’s papers and debts are up to date.

Keep in mind that all these investment alternatives have natural limitations, such as the location of the property, its accessibility, and current demand, as well as artificial ones, such as co-ownership agreements for office buildings and apartments and condominiums debts associated with real estate.

Be informed:

Although it is not necessary to have studies or a degree to dedicate yourself to investing in the real estate sector, it is essential that, when you are in the business, you know basic concepts of the industry, such as the price/cost differential, capital gains, generation value, the profile of the investor and the type of property. The fact that you do not master the vocabulary of the world in which your company operates can lead, at least, that people distrust you.

In this sense, a fundamental behavior to be more and more informed about the business is to listen carefully to people associated with the company. In this way, you will not only be able to access privileged information about your clients, but you will also gain more and more confidence in your expertise.

This same practice will affect your pricing method. Whether you are based on margins, target prices, demand, competition or the highest possible value, it will always be essential to be informed to define the amounts of your business most appropriately.

Have a plan:

Discipline always translates into success, and this habit has much more to do with being active and constant at work than being rigid and unable to react to changes. This is why, when we talk about having a plan and abiding by it, what you must understand is that before entering the real estate market you should take some time to design your business plan.

This plan will help you establish critical aspects, such as the vision and goals of your company. Still, it will also encourage you to protect your business with a series of rules that ensure the decisions you will make throughout your career as an entrepreneur in the field.

You will be able to establish specific things such as your target market, selection criteria and even the selection criteria of your properties. Put yourself before problems through a contingency plan that consider your investment’s risk analysis and the financial viability of a purchase or a sale.

Find allies:

The real estate business tends to be independent and lonely because it allows practitioners individual freedom and flexibility compared to other jobs. For the same reason, it is advisable to go to good allies to maintain a good network of contacts and grow in a highly competitive and agile market.

With allies, we mean reading books that teach methods to achieve financial “good health” or encourage the practice of habits to be effective in business, even attending courses and seminars designed especially for people who want to learn everything necessary to function. Successful in the world of real estate investment.

It is also advisable to interact with real estate agents and financial advisers to listen to their experiences and opinions, but above all to finish inserting themselves more and more into the beautiful and complex world of real estate.

Finally, a good idea to become a great real estate investor is to interact with ordinary people who are examples of success, either due to their personal experiences or economic fluctuations in business in general and within the field.

It is a type of inspiration that you can also find in opinion leaders with a good presence in social networks and participation in books, courses and seminars in the field.

So, these are some of the strategies that beginners should keep in mind while entering the real estate market. Make use of these strategies and excel in the real estate market of Pakistan.

Real Estate Strategies for beginners

Scandinavian Home Interiors Six Different Ways

Like Architecture and Interior Design? Follow us …

Thank you. You have been subscribed.

![]()

Scandinavian Home Interiors goes from strength to strength, appealing to our appreciation of clean lines, airy living spaces, and our need for everyday practicality. This collection of inspiring Scandinavian home designs explores six different ways to customize the aesthetic. We start with a creamy and serene elegant apartment where indoor plants meet natural wooden elements. We follow with a colorful Scandi interior that uses pink and kerchy accents to elevate and customize a neoclassical setting. Beige, gray, and beige decor colors of home number three, while design four resides in the minimalist monochrome domain. We end up with a classic Scandinavian-style black-and-white contrast, and a book lover’s home with a quiet mezzanine workshop.

Did you like this article?

Share it on any of the following social media below to give us your voice. Your comments help us improve.

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.

Scandinavian Home Interiors Six Different Ways

- Published in decor, Designs by Style, home, Home Decor, home design, house design, interior, Interior Decoration Ideas, Interior Design, interiors, International, scandinavian

A Book Lover’s Mid-Century Modern Home

Like Architecture and Interior Design? Follow us …

Thank you. You have been subscribed.

![]()

Mid-century modern elements add style to the home of this comfortable book lover, layering a contrasting color over a rich wooden tone. Designed by NDB Design’s Ni Dongbo, a lack of architectural features has been overcome by creative interior treatments of sculpture, wall art and literary treasure. Mid-century modern accent pieces are combined with contemporary components to create an interesting, eclectic style that keeps the eye moving and the mind wandering. Crisp white walls provide a fresh backdrop for the bright, prominent furniture and make a quiet frame for two well-stocked home library walls. The unique home is covered in natural greenery that just combines the interior with abundant outdoor views.

The large open plan residential location is located on the second floor of the home. Beneath it, the entrance and modern staircase design are full of bright natural light. As if presenting the theme of this book lover’s apartment, an embedded bookcase is carved into the white stucco wall of the lobby. A high stepped back chair and a unique side table make up a sculpted furniture arrangement for reading under the stairs.

Did you like this article?

Share it on any of the following social media below to give us your voice. Your comments help us improve.

Watch this space for more information on that. Stay tuned to Feeta Blog for the latest updates about Architecture and Interior Design.

A Book Lover’s Mid-Century Modern Home

Buyer’s Market vs. Seller’s Market: Know the Difference

Would you like to sell or buy a home at the best time of year? Despite the fact that certain seasons may be busier than others, the fluctuations in the real estate market are much more influenced by supply and demand than by the time of year. Keeping an eye on the housing market is one of the most important things to watch and watch out for whether you’re in a buyer’s or seller’s market in your local area.

Everybody wants the best deal on a new home, but it’s not always easy. In the wake of the COVID-19 pandemic prospective homebuyers have had a difficult time answering the question, “Why are houses so expensive at the moment?”.

In order to save on a new home and avoid overspending on the mortgage, savvy homebuyers try to time their purchases around buyer’s markets.

When purchasing a house, it is important to know the difference between buyer’s markets and seller’s markets. Let’s find out more with this blog.

What Is a Buyer’s Market?

Buyer’s markets occur when more homes are for sale than buyers are available. It means that more homes are listed for sale than there are buyers. Buyer’s market often refers to the state of a market where there is relatively more inventory than demand.

Lower home prices are an indicator of a buyer’s market. A seller’s home will often sell for around the listing price or even less in a buyer’s market. You cannot raise your asking price much without causing buyers to look at comparable homes offered by other sellers in your neighborhood.

Due to the volume of competition, sellers are at a disadvantage. Many sellers decide to accept a lower sale price instead of waiting for the right buyer to come along.

Seemingly longer than average time on the market is another sign of a buyer’s market. There’s likely a buyer’s market if the for-sale signs aren’t replaced with sold signs as you drive through your neighborhood. There is little chance of seeing a bidding war over a house on the market. With so many homes available, buyers are unlikely to spend more than the asking price.

What is a Seller’s Market?

During a seller’s market, the number of buyers overrules the number of available homes on the market or when there are more buyers than available homes. A single property often attracts multiple buyers, resulting in a bidding war. Selling your home in a seller’s market can be a great option because you can get a higher sales price than your listing price, or at least more than your bottom-line price (the lowest price you’re willing to accept for your house).

Be aware of the seller’s advantage when buying a home in a seller’s market. The advantage of getting a lower sale price on a property that other buyers are interested in is unlikely if other buyers are also interested.

An offer made by a competing buyer could cost you the opportunity to buy the property. The seller’s market is sometimes referred to as a renter’s market because sometimes prospective buyers must continue renting until they can raise their down payment and compete with other buyers.

According to a licensed realtor from FL Cash Home Buyers – the key to selling a property fast is to utilize as broad of a net as possible for buyers. The key to this is to find the right realtor. Realtors can help sell a house not only quicker but usually more profitably and as legally correct as possible.

The market for Buyers or Sellers? Find Out with These 4 Tips

A buyer’s or seller’s market can be determined without being an expert in it real estate. The easiest way to tell can usually be found by looking at current and recently sold listings.

A buyer’s market has the following characteristics

- Sales of homes are slow

- The homes sell for less than the list price

- The home price index is declining

- There are many homes available for sale

A seller’s market has the following characteristics

- Houses sell quickly

- The home sells at or above the listing price

- The price of homes is rising

- There aren’t many homes for sale

A Few Tips for Buyers

When there are limited housing options and a lot of buyers are interested, time is of the essence.

- A seller’s market is an excellent time to act fast if you find your dream home. Those who hesitate over a house they want to buy may find it is no longer available by the time they are ready to negotiate. Getting pre-approval for a loan before you need it will ensure financing.

- Make sure you know you’re at a disadvantage before you make an offer. There is no need to push for specific closing dates, concessions, or contingencies in a seller’s market. Make sure you focus on what’s important to you. Make sure you think twice about stipulations you want to be written into the contract. Make an all-cash offer if possible. Since cash buyers don’t have to deal with financing issues, sellers prefer them.

- Having patience is crucial when you keep losing out on the homes you are interested in. Don’t get discouraged if you keep losing out on homes you are interested in. Frustrated buyers end up suffering in a seller’s market. Many inexperienced bidders engage in bidding wars to get the home they want, even if the home isn’t worth much. That’s not a good idea.

- If you are tired of losing, you may end up making an offer on a home you wouldn’t usually be interested in. Property ownership is an investment and often a 30-year commitment. Don’t get sucked into a low-cost house. You’d be better off waiting until the market cools off before starting your home search.

A Few Tips for Sellers

To increase interest in your property in a seller’s market, you’ll need to compete with other sellers.

- Before you market or show your property, make sure your home is clean and organized, and in good condition.

- The price of a home tends to rise in a seller’s market, but pricing your home relatively still helps. You’ll be more likely to attract buyers if you lower your asking price slightly below fair market value. It is common for sellers to list their homes slightly below their assessed value to encourage bidding wars.

- Examine offers carefully: During a seller’s market, it’s even more important to consider offers carefully. In their search for the highest offer, sellers frequently ignore the buyer’s financial strength. If buyers say they will pay a certain amount, that doesn’t automatically mean they can get the funds. The appraised value of your home cannot be financed beyond that.

- Your last concern should be accepting an unrealistic offer and then having to resell your home when the deal falls through. Buyers will have more power when negotiating when your house has been on the market longer.

- Make sure any buyer who requires financing is preapproved for a loan. When buyers receive pre-approval, their credit and finances are verified, ensuring they can obtain a loan for a specific amount. Prequalification, however, is merely an estimate of a buyer’s finances.

- Observe contingencies: Also, be aware of offers that include contingencies. In the event that certain conditions are not met, buyers can back out of sales contracts, including mortgage house contingencies, home sale contingencies, appraisal contingencies, and inspection contingencies.

- According to Phil from Cash offer Please, Many homeowners choose to sell their homes through a real estate agent in order to get the best price. However, you may be able to sell your home for less than market value by making a cash offer to the buyer.

Summary

Knowing where the market stands is beneficial when buying or selling property. There is less competition for buyers in a buyer’s market when there are many homes available. On the other hand, a seller wants to list their house during a seller’s market when there are fewer properties for sale and a high number of interested buyers.

It is still important to hire a real estate agent, regardless of the market conditions in your area. A real estate agent can give you a leg up on your competition, regardless of market conditions.

Choosing the right time to buy a home can be a major challenge. In a seller’s market, you will notice that homes disappear almost immediately after being listed. To avoid losing out on what could be your dream home, you should get preapproved as soon as possible instead of waiting until the last minute.

Buyer’s Market vs. Seller’s Market: Know the Difference

Pros and Cons of Homeowner Association

Several localities offer residents the option to join a homeowner association. These associations can be quite helpful in resolving minor community issues. However, they may come with several drawbacks that need to be considered. To understand the pros and cons of joining HOAs, you must first understand what HOAs are, what they do, and how they affect homeowners.

What are HOAs? A question that you might be wondering. The term simply refers to homeowner’s associations, which manage a community for the benefit of its residents.

What does HOA mean in Housing?

Homeowners associations exist to manage residential communities, maintain curb appeal, and keep property values high. In addition to this, property owners’ associations manage residential communities. Home developers are responsible for initiating the association.

As a result of legal advice, the developer drafts the association’s governing documents. Bylaws, amendments, rules and regulations and articles of incorporation are among the documents.

Simply put, it would mean living in a house that is a part of an association. Although there are plenty of benefits to living in an HOA, it may not be suitable for everyone. Living in an HOA community, for example, gives you access to amenities you would not otherwise have.

What is the purpose of an HOA?

As soon as you move into your new home that is registered with the association, you become a member. The HOA’s governing documents are automatically applied to you as an HOA member. The documents outline the dos and don’ts of a homeowner. Rules like these help preserve property values and keep neighborhoods safe.

Managing an HOA entails taking care of the best interests of the community, enforcing rules, and setting the amount for dues. A review of the HOA’s governing documents is recommended before moving into a homeowner’s association.

Pros of HOA

Here are some pros of HOA that can help you make a decision.

1. HOAs are responsible for maintaining common areas

The aesthetic appeal of a well-maintained community contributes to the ease of living within it as well. A landscape that offers clean roads, trimmed trees, and blooming flowers, brings harmony and peace. The wellbeing of a community is important, and it is comforting to know that these services are in place.

The benefits of living in a community with an HOA include common community areas being maintained by the organization. Swimming pools, playgrounds, barbecue areas, and community centers are included.

The spaces can be enjoyed without having to worry about maintenance. In addition to maintaining the landscaping in front of each unit, some HOAs also take care of maintenance in the backyards of residents.

2. A consistent value for each property

Property values are a primary reason people buy an HOA home. Your board helps you protect your investment and ensures its value remains the same. It is the owners’ responsibility to maintain their lawns, homes, and personal property in accordance with community laws. This offers several benefits for the homeowner as well as the community. The members of the board live in the same community, and they are just as eager to see it thriving as you.

3. Complying with standards

Every homeowner must follow certain guidelines. Prior to signing on the dotted line, buyers should familiarize themselves with the governing documents. There isn’t much tolerance for unruly behavior in a typical association – from a wild party in someone’s backyard to disregarding architectural guidelines. The neighborhood has a board that mediates neighbor disputes and sets forth consequences when things don’t work out.

Cons of HOA

Let’s take a look at the cons of HOA.

1. HOA fees must be paid monthly

Residents of the community must pay HOA fees because the association maintains the common areas and exteriors of homes.

The fees for these amenities vary from community to community. In addition, HOA fees are not set in stone, so they are subject to change from time to time. When the association is unable to collect enough funds to maintain the community, the association may have to increase the monthly fee.

2. Failure to pay HOA fees can have serious consequences

Paying your HOA fees is an important part of living in a community. Fees must be paid by all residents of the community. If the HOA remains unable to collect enough money from residents, the property may not be able to be properly maintained. This can result in the association firing the property manager, causing the community’s appearance and condition to deteriorate.

3. Rules and regulations are enacted by the HOA

The HOA sets requirements for your home’s appearance. Ranging from what type of front door and windows you can have to decide what color your front door or shutters can be painted – the association has complete control over your home’s appearance. You may even be restricted in how much outside decor you can use and how many vehicles you can park in your community. If you violate the community’s rules and regulations, you could receive a fine.

4. Inadequate management

Poor management can lead to deterioration in some HOA communities. As a preventative measure, electing board members who have the association’s best interests at heart is the perfect way to avoid such a situation. In addition, many HOAs hire a management company to ensure responsibilities and duties are properly fulfilled.

5. Foreclosures and lien rights

A lien or foreclosure is always a concern when living in an HOA. There are certain HOAs that can place links on your property and then foreclose on it. The lien will only occur if your association due aren’t paid.

Conclusion

It’s important to consider the pros and cons of living in an HOA before making a decision. Paying monthly fees and adhering to the rules of an HOA community is necessary. You’ll also benefit from things like preserving your property value and being able to access well-maintained amenities (like landscaping). In the long run, you will benefit more from HOAs if you can tolerate the minor inconveniences they bring.

Stay tuned to Feeta Blog to learn more about Pakistan Real Estate.

Pros and Cons of Homeowner Association

51 Tea Rooms Design Ideas With Tips And Accessories To Help You Design Yours

Like Architecture and Interior Design? Follow us …

Thank you. You have been subscribed.

![]()

The inseparable Tea Rooms Design culture of East Asia is well-known, where tea is much more than just a pleasant drink. Not only is tea enjoyed in person and at social events, in small tea parties and in public teahouses, but many cultures have created intricate formal ceremonies around the act of tea preparation and service. While East Asian tea ceremonies differ between countries, the ritualistic nature of the drink is agreed upon. This pleasant daily observation has inspired the inclusion of personal tea rooms within modern homes, which is what we are exploring here today. From traditional Asian tea tables and tatami mats to contemporary interpretations of the theme, we will discover how to raise tea at home.

The seating label in a traditional Chinese tea house conventionally requires that the first guest of honor be located on the left side of the host. The remaining seats are allocated in descending order to the right. Therefore, a common bench will most likely come after single seats if the length of the table allows.

Did you like this article?

Share it on any of the following social media below to give us your voice. Your comments help us improve.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.

51 Tea Rooms Design Ideas With Tips And Accessories To Help You Design Yours

- Published in decor, Designs by Style, dining room, houses, interesting designs, interior, Interior Decoration Ideas, Interior Design, interiors, International, Investment, tea rooms, uk, ukraine, USA, viral, Zillow

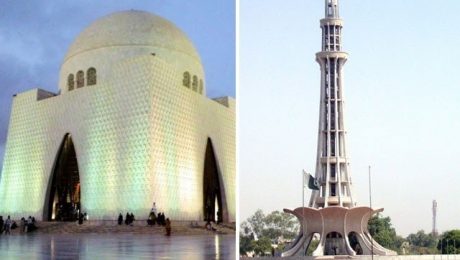

Karachi Vs Lahore – Which One is Better?

Karachi Vs Lahore – Which One is Better? This is a question people ask all the time.

Karachi and Lahore are the two most famous cities in Pakistan. Both are known for their rich culture and amazing hospitality. Karachi is popular for being an economic hub, whereas Lahore is popular for its amazing heritage and beautiful architectural buildings. Both the cities have their own importance and are unique in their own way.

Let’s have a look at the basic factors of both Karachi and Lahore.

Karachi

Karachi, the city of lights, is the 8th most popular city in the world. There are several reasons for being most popular. Its history, its culture, fashion, trade, entertainment and investment are some factors that contribute towards it. The city is super busy in comparison to any other city in Pakistan.

If you plan to go somewhere, you will have to leave an hour before, because Karachi has always witnessed immense traffic. While traveling in Karachi, you will notice that the city is full of energy, warmth and enthusiasm. Residents of Karachi are diverse in cultures, ethnicities and religions. All these aspects add to the diversity, versatility and uniqueness of the city of lights – Karachi.

City Size and Population of Karachi

The metropolitan city has a population of more than 23 million and a population density of almost over 24,000 people per square kilometer. Which makes it clear that Karachi is denser than any other city of the urban population in Pakistan. This is why Karachi is the largest city in Pakistan.

Demographics of Karachi

It is believed that almost 90% of the population in Karachi are migrants from various backgrounds. For a large number of Gujarati Muslims, Karachi has historically been a home. Communities of Gujarati Muslims include Chhipa, Memon, Khoja, Ghanchi and Tai.

Many non-Muslims left Karachi for India after the 1950s. Therefore some small communities of Parsis, Anglo-Indians and Goan Catholics are still present in Karachi. Muhajirs in Karachi are large in number ie is almost 50% of the population, which includes Gujarati, Rajasthani and Malabari Muslims.

After Muhajirs, the second largest group in Karachi are the Pashtuns, 25%, who hail from Balochistan and Afghanistan.

Growth in Karachi’s Population

At the rate of around 5% per year, Karachi is growing. Almost 45,000 migrant workers come to Karachi from all over Pakistan every month. It is expected that rapid growth in the population of Karachi will make it the seventh-largest city in the world by 2030.

Weather of Karachi

Summers in Karachi are very hot, arid, windy and oppressive, whereas winters are short, dry and more comfortable than summers. The temperature in Karachi varies from 55 F to 94F. It is above 100F and below 49F.

Transport of Karachi

For shorter routes, people of Karachi use rickshaws or taxis, and for longer routes, they prefer transportation through buses, which is far cheaper than any other mode of transport.

Places to visit in Karachi

Here is a list of some of the most famous places to visit in Karachi.

The Beach

Going to the beach has never been a regret! We always enjoy ourselves and spend hours and hours at the beach without realizing the time. Karachi is famous for its beautiful beaches. Tourists from Pakistan always make sure to pay a visit to the beach during their stay in Karachi. Sea view beach is the closest to the city, and no matter what the time is, it has always been crowded.

Winter Land

For the people of Karachi, winter land is a huge bliss! Because of the hot weather in Karachi, people don’t get to experience rain and winds for a long time. Winter land is a place to experience when you feel like having some fun by getting some winter vibes. The place offers several fun activities, such as bumper cars and slides.

Mohatta Palace

To experience Indo Saracenic architecture, Mohatta Palace is the place to visit in Karachi. In 1927, it was built as the home of Shivratan Mohatta. It is open to the public from Tuesday to Sunday from 11 am to 6 pm. The palace contains a secret passage, a 1km path underground and leads to a Hindu temple. In this palace, you will also find various displays of British culture from the subcontinent.

Brother Hall

To experience Karachi’s British colonial history, Frere hall is a Venetian gothic building that one must visit. Frere Hall is Karachi’s most iconic place, with a beautiful mural painted by one of Pakistan’s most revered artists Sadequain Naqqash.

Empress Market

Named after Queen Victoria, the Empress market has been in operation for years. From groceries, spices, seafood to some fun activities in Karachi, the empress market has been a popular place. It is one of the busiest places in Karachi for shopping.

Food culture in Karachi

Karachi is famous for its food. Here is a list of restaurants in Karachi that are known for their delicious cuisine.

- Behari tikka at Meerath Kabab House

- Dum Biryani from Gol Market, Nazimabad

- Fish by Yadgar

- Katakat and Brain Masala from Noorani at Do Darya

- Beef fry kabab at Burns Road by Waheed

- Javed Nihari (dastagir, FBArea

- Nihari by Ghaffar Kabab House

- Afghani Boti at Al-Asif

- Afghani Pulao by Al-harmain

- Peshawari chapli kabab by A-one (Shah Faisal)

- Balochi tikka from Madina 2, Superhighway

- Karahi by anwar baloch (Malir)

- Kali Mirch Chargha by Cafe Laziz

- Hunter beef burger from Hanifa

- Super bun kabab at Pakistan Chowk

- Cheeseburger by Khan Broast, Near Waterpump

Universities in Karachi

With a literacy rate of 65.26%, Karachi has some of the best universities in Pakistan. There are almost more than 50 colleges and universities that are located in the capital of Sindh. The categories of colleges and universities include science, arts and commerce.

Top universities in Karachi include:

The Jinnah University for Women, located in Karachi, is the pioneer university for women in Pakistan

The University of Karachi is the largest in Pakistan with the largest faculty.

NED University of Engineering and Technology is Pakistan’s oldest engineering institute located in Karachi.

The National University of Computer and Emerging Sciences, NUCES-FAST, is recognized as one of the top universities in Pakistan. It has two branches in Karachi.

Lahore

Let’s find out about Lahore now.

A lot of travelers in Pakistan start their adventure in Lahore, The heart of Pakistan. The city is known for its vibrant, hospitable and joyful atmosphere. But, we cannot forget Lahore’s scrumptious food, which you cannot find in any other city in Pakistan. Lahore has been of great importance when it comes to geography and culture. There are a lot of fun places in Lahore that you and your family can visit.

Colonial and Mughal dynasty eras can be witnessed all over the city with several beautiful historical architecture buildings. Because of Lahore’s fantastic taste, Lahore is also known as the food capital. Several places can be visited in Lahore to experience the beautiful architecture of the walled city. Rich in history and tradition, Lahore has experienced three eras: Mughal, British and modern.

City Size and Population

With the boundaries of 1772 kilometers, the current population of the city is 7 million. In the past 14 years, the city has expanded due to its growing population. Because of this, it remains the 42nd most populated city in the world. The population density of the city is nearly 63000 residents per square kilometer.

Population Growth in Lahore

With a population above 11 million, experts thought that Lahore would become a central megacity by 2025, but it has already become. With an increase in Lahore’s population, it is expected to become the largest populated city by 2050, with almost 42.46 million people.

Weather of Lahore

With an average high of 102F and a low of 83F, the hottest month in Lahore is June. Winters in Lahore last for almost 2.5 to 3 months, with an average low of 47F and a high of 66F.

Transport of Lahore

Modes of transport used in Lahore include bus services, rickshaws, taxis and metro services. Two major providers of bus services are Lahore Transport Company and Punjab Mass Transit Authority.

Places to visit in Lahore

Here is a list of places to visit in Lahore.

Badshahi Mosque

Located in Lahore, constructed by the Mughal emperor Aurangzeb, Badshahi Mosque is the largest mosque of the Mughal era. It is one of Pakistan’s most iconic sights that people all over the country love to visit. It is known as the crown jewel of Lahore with a large courtyard that can comprise almost 10,000 people.

Fort Road Food Street

Fort road food street has some of the best restaurants in Lahore. The food street has beautiful and colorful buildings with rooftop restaurants for citizens to enjoy the view. There are both desi and continental restaurants with amazing food quality.

Delhi Gate Market

The old city of Lahore had almost 13 gates to it. When the British conquered the region all of these were destroyed. However, 6 out of 13 were rebuilt, and Delhi Gate is one of them. The entrance leads to a busy market filled with lots of happening and life. It’s a great place to visit if you want to have a look at the local life of Lahore.

Anarkali Bazaar

Anarkali bazaar is divided into two, the old and new. While on your visit to Anarkali bazaar you will get to find a lot of traditional foods, clothes, jewelry and handicrafts. Walk-in Anarkali bazaar has always been an interesting thing to do for people; even if you don’t want to buy anything, a walk at Anarkali bazaar is also enough to enjoy the locality.

Shalimar garden

Visiting a Shalimar garden is one of the most relaxing things that the people of Lahore tend to do. It is a great option if you want to spend time with your family. There is a beautiful fountain with colorful flowers to create a welcoming and comfortable atmosphere for visitors.

Universities in Lahore

With a literacy rate of 64%, Lahore is considered to be a primary education hub of Pakistan with some top universities. Almost 40 licensed universities offer degrees in business, science, humanities and engineering.

The University of Punjab, Government College University, and Forman Christian college are Pakistan’s oldest universities. The recently-established University of Lahore is a private university and offers programs in medical sciences, health sciences, biology and engineering.

Conclusion:

Both Lahore and Karachi are unique in their own way. The cities are of great importance to Pakistan. Lahore, because of its historical architecture, and Karachi, because of its vastness. In this blog, Feeta.pk has listed down the stand-out features of both cities.

Which one is your favorite? Let us know in the comment section below!

Karachi Vs Lahore – Which One is Better?

Corner Apartments | Pros & Cons

Corner houses and apartments are the first choice for investment or living for all. Real estate holds high value for corner houses, and especially apartments, given that they come with their own perks.

However, there is still an ongoing debate about whether or not investing in a corner apartment is ideal, there are significant pros and cons of corner apartments that one should keep in mind while making the final decision.

In this blog, Feeta.pk discusses all the upsides and downsides to getting a corner apartment so you can make an informed choice.

Corner Apartments | Pros & Cons

Pakistan’s real estate sector is shifting towards increasing the development of vertical landscape, and this is giving rise to the availability and demand of apartments. This need for apartments is simultaneously adding to the rising demand for corner apartments. Let’s take a look at some facts that can help you decide if it’s worth it.

Why Opt for a Corner Apartment

Starting with a good note, corner apartments are everyone’s preferred choice because of multiple reasons. These reasons factor in to help you live comfortably.

Privacy

As apartments typically come with balconies and a back terrace, a corner apartment actually gives you privacy in the balcony as there is only one neighboring balcony, and the other side is free. This is ideal for people who love to keep their privacy intact and have introverted personalities, thus keeping you at a distance from any nosy neighbors that you may have.

Additional Square Footage

Because of the huge infrastructure and architecture involved in elevating an apartment complex, corner apartments usually get extra square feet in their space.

Because of this, they look and feel wider than other apartments of the same building. For instance, we can understand this by taking the example of an apartment covering 850 sq. M. ft. In this, the corner apartment may be about 120 sq. M. ft. larger due to its positioning in the building. This is a very prominent advantage that makes people prefer corner apartments.

Extra Ventilation

Even though apartments, generally, are great with ventilation as compared to houses, Corner apartments come out at the top. This is based on their L shaped design, which leaves more outdoor areas for ventilation. With corner apartments, we can also credit the importance of windows and how they keep the ventilation flowing, leaving your house fresh.

Having extra ventilation keeps your house temperature cool in summers, and the fresh air is great for your health. Besides this, good airflow keeps your house safe from water seepage, mold, and other issues that are likely to stem from a closed space.

Scenic Views

Corner apartments have the most beautiful views, and that is a sure fact. This is one of the biggest reasons why people choose to live in corner apartments. With the extra balcony space, and windows around, you can enjoy the scenery any time of the day.

Source: Pinterest

Even if there are no green areas around or any parks to view, you can always enjoy the night view of the twinkling lights from houses and buildings around that make a great view from the corner apartment.

Why Not Opt for a Corner Apartment

With so much value, there are a few drawbacks that can come in the way of your decision to live in a corner apartment. This may be a big factor for some, and for others, it can be insignificant.

A Lot of Sunlight

Source: Pinterest

Although this remains a variable according to the location and direction facing of an apartment, corner apartments usually get more sunlight than others. This is because there is less view blocking and more windows.

This drawback may be considered as an advantage by some who live in cooler weather conditions, but in Pakistan, summers can be really harsh and the sunlight can become unbearable.

More Expensive

Because of their high demand and less availability, as well as the perks that come with it, corner apartments cost higher than other apartments. Real estate has a lot of demand and value for corner houses and apartments, and resale, investment, living in these is always the ideal choice for people.

People who love the benefits that come with living in a corner apartment are willing to pay more just to create a better home or invest in a better property that will give profitable returns in the future.

Prone to Noise Pollution

Even though corner flats have more privacy than other facing flats, they can have more noise overall as well. This is because they are usually situated by the roads and intersections, busy with traffic and people passing throughout the day.

This can cause disturbance for you all day and disrupt the calm environment that your home needs.

Corner Apartments -Ground Floor

These are actually on the lower end of the cost spectrum and cost like other apartments. The difference? Well, corner apartments on the ground level do have privacy and ventilation, but the airflow and scenes are not the same.

People living in such property have to keep their windows covered at all times to avoid nosy neighbors and people passing by who want a peek. Because of keeping the windows covered, the temperature and ventilation are disturbed.

Considering both factors for corner apartments, the decision eventually comes a lot to how all these things are affected by the location, city and weather of the area.

If you’re looking for a corner apartment to move into, or are deciding to for a corner housethe above-mentioned facts can help you understand according to the location you are going for.

You can find out more information about apartments and housing at our Feeta blog.

Corner Apartments | Pros & Cons

- Published in International, Lifestyle, property, property management, Property News, Real Estate Guide, Real Estate News, uk, ukraine, USA, Zillow

Choosing Construction Materials for Your Home

Being the foundation of any house – construction materials should be selected after thorough research and evaluation. Anesthetic design with sustainability is only possible with the proper construction material. However, many remain unaware of the significance of choosing the right materials, foregoing this important step entirely.

To help you make the right decision for your home, Feeta.pk brings you a complete guide on how you should choose construction material for your house.

Estimate your Costs

The construction market offers a wide variety of quality construction materials. However, their prices may vary significantly. Opting for the highest-grade materials should be the right move if you have a limitless spending budget since durability and sustainability are the utmost priority.

However, there will be a limited spending budget in most cases, and finding the perfect materials for your home under a limit can be quite tedious. As a general rule, choose cost-effective materials without compromising overall quality. Estimating a budget can help know how much you can spend on materials, cut down on unnecessary costs and make room for better construction materials.

Availability of Materials

Source: EnvatoElements

Before deciding on any materials, it is essential to determine their availability in the market. Materials that are either rare or unique can become impossible to find in the market, or they might have to be shipped from a different country. This can raise costs and delivery times for the construction and building materials, affecting the overall timeline for the construction of your house.

Climate Conditions

Source: EnvatoElements

Construction materials for homes greatly depend on the climate conditions of the area. Factors such as average rain, snowfall, sunlight, and temperature are essential determinants of the materials. Some materials perform better in cooler temperatures, while others deteriorate under heavy rain or snowfall. This makes it necessary to consider the whole climate while choosing construction materials.

Sustainability

Source: EnvatoElements

With climate activism at an all-time high, the construction industry has also taken a few steps to incorporate sustainability. Construction materials are responsible for a significant portion of the world’s carbon footprint, especially materials such as cement. This has led to a rise in the use of eco-friendly construction materials. If you want your house to be greener, the construction market has several sustainable options that you can explore.

Aesthetic Appeal

Source: EnvatoElements

Another factor to take into consideration while choosing materials is their aesthetic appeal. Construction materials can drastically change the aesthetics of your house. For instance, laminated wooden flooring can give your home a touch of elegance, while opting for ceramic tiles can offer a minimalistic appeal.

The materials that you choose should also complement the surroundings of your house. A log cabin-style home may look pleasant in the hills of Murree but not so much in the streets of Lahore. Your home’s aesthetic appeal should mirror its surroundings while incorporating your unique taste.

Durability

Source: EnvatoElements

Durable construction materials are essential for any home, increasing lifespan and lowering maintenance costs. Some materials can offer universal durability, while others are climate-dependent. Generally, construction materials should be repellent to moisture, corrosion, and other environmental conditions such as heavy rain.

Structural Integrity

Source: Pinterest

For construction materials, it boils down to structural integrity and performance. The materials that you choose should withstand heavy loads and excessive weights. The choice of materials should be evaluated, and there should be no compromise on quality. Anything made out of poor quality can become a safety hazard.

Maintenance

Source: EnvatoElements

The best construction materials are those that require minimal maintenance. Maintenance is necessary for preserving your home’s original look. However, it can also rack up additional costs over time. To avoid these costs, opt for high-grade quality materials as they offer higher durability and less maintenance over time.

Construction material should always be selected after thorough research. Factors such as durability, aesthetics, and climate conditions should be considered. However, the general rule of thumb is to never compromise on quality, as these materials are the core of your house. For more information on construction materials, visit Feeta.pk – Pakistan’s first online real estate market.

Choosing Construction Materials for Your Home

Top Bedroom Furniture Ideas in Pakistan to Refine Your Bedroom

After a long and tiring day, all one needs is to relax in the place that you feel most comfortable in, i.e. your Bedroom Furniture. Your room is your safe space, and decorating it with your favorite pick of bedroom furniture design can make your bedroom just the dreamy place where you can relax.

Choosing the right bedroom furniture sets can have a major effect on our day in the long run. Our entire day depends on how we are taking care of ourselves, taking a good amount of sleep, how we are relaxing our backs on the mattress and bed set.

You can take a look at this collection of bedroom furniture in Pakistan that Feeta.pk has compiled for you to bring instant comfort and aesthetics to your room.

Popular Ideas for Beautiful Bedroom Furniture in Pakistan

When you’re choosing your bedroom furniture, you need to pick a theme and just go with what will look best with it. There is a vast variety of types and sizes of furniture that you can get to create just the desired aesthetic that you want.

Here are some modern bedroom furniture ideas that you can utilize while refining your bedroom into the relaxing and comfortable space that you need.

Chocolate Bedroom Furniture Design

The simpler, the better.

In Pakistan, heavy wood is generally used for making bedroom furniture which can be very expensive if carved. So keeping it simple will not only be affordable for you, but also give your furniture a rich effect, but it will also be very useful for you to restyle with any theme you want to set your room with, for many years to come.

This chocolate brown design incorporates not only minimalism but also delivers elegance on a simple budget. The dressing table is a stylish and compact design, that perfectly complements the bed set and the cupboards.

Cherry Wood Bedroom Furniture Design

Source: Pinterest

This cherry wood furniture design is a beautiful and modern furniture design that has brass detailing that brings out an elegant finish to the furniture. It comes with a dresser that has multiple drawers, as well as side tables to complete the bed set.

The cherry wood is a beautiful color if you’re looking for a rusty and warm theme. It is a very popular choice for bedroom furniture in Pakistan. Not only is it minimal, but also very stylish.

Wall-Mounted Head Rest Bedroom Furniture Design

Source: Pinterest

Wall-mounted headrests are the new thing since 2021! These are making round around the interior industry and is a famous choice for bedroom furniture. Although this falls more on the expensive end of the spectrum, this is a very luxurious and beautiful design that will elevate your bedroom.

It typically comes as a cushioned headrest that is detailed with brass or gold, and on the side, you can incorporate mirrors or leave as be. This is a very lavish bedroom furniture choice that is bound to awe your guests and also create a pleasing and relaxing environment for you.

Extended Headrest Bedroom Furniture Design

Source: Pinterest

This modern bedroom furniture design features an extended headrest that encloses the side table space. It gives off a very neat and minimal look that refines the aesthetic of your bedroom. Because it encloses the side tables, it gives a compact and organized look to your room.

The brass detailing in furniture seems popular, but it is actually optional, you can switch it with any other details or even leave it simple for a clean and sophisticated look.

White Bedroom Furniture Design

Source: Pinterest

This white dreamy aesthetic with a white backdrop is just the calming environment that you need after a long day. White bedroom furniture is a very common choice for people who love a calming and soothing aura.

You can always style white bedroom furniture with cream colors, or pastel hues to keep a cool decor, or switch it up with a pop of dark colors to freshen up the theme of your bedroom every once in a while. White is also an ideal choice if your bedroom is smaller in size, as it gives a more open and wider feel to the room.

Black Bedroom Furniture Design

Source: Pinterest

This one is for all the black enthusiasts, who love a dark and calming vibe to their bedroom. Black is a great color to go with grays and cream shades, as well as silver detailing that gives it an elegant finish.

Black bedroom furniture is a very unique choice that you can make and set a theme for your bedroom. Not only does it look rich and luxurious, but it also sets an elegant theme for your bedroom.

This is better off with a complete set of furniture, with dressing table, cupboards and side tables black as well, since only a black bed set might look singled out for the room.

Mahogany Bedroom Furniture Design

Source: Pinterest

Mahogany wood or color is a very popular choice in bedroom furniture in Pakistan. This is a rich color that goes well with all themes and remains vibrant throughout the years.

If you’re opting for a mahogany colored bed set, try choosing a simple design and bed set with minimal geometric details that will keep your room aesthetically pleasing. The best thing about this is that it can fit in with dark hues, pastel colors, and even contrasting colors.

So if you’re someone with colorful interests, this is the optimum bedroom furniture design for you.

Gray Cushioned Head Rest Bedroom Furniture Design

Source: Pinterest

This cushioned and studded design is a very popular choice in Pakistan, that not only revamps your bedroom look but also gives you a comfortable and relaxing space. The cushioned headrest is very comfortable and also gives a luxurious finish to your bedroom furniture.

It is a modern design that looks ravishing in almost all colors, especially dull tones like mauve, gray, white etc. The best is to pair the bedroom furniture with different hues of the same color for a rich finish.

This article will assist you in choosing the right type of furniture for your bedroom, with all the right aesthetics that will reflect luxury and elegance.

If you’re still confused about the type and size of your furniture for your bedroom, you can look up these 50 small bedroom ideas that you can incorporate while revamping your bedroom.

For more innovative ideas and creative tips, you can follow our blog at Feeta.pk.

Top Bedroom Furniture Ideas in Pakistan to Refine Your Bedroom

- Published in bedroom, bedroom design, Bedroom Designs, Decoration, furniture, Furniture Design, house, house decoration, house design, houses, International

Plastic Roads | How will they help?

For Plastic Roads, Plastic is a material so hazardous that it may be at the forefront of causing climate change, yet the human population cannot survive without it. For decades, scientists have tried to find a solution to decomposing plastics, yet their research remained unable to decipher this predicament.

The only solution that remains is recycling, and what better way to mass recycle plastics than to make infrastructure out of it? This was the idea behind the innovation of introducing ‘Plastic Roads’ – a cost-effective way of addressing infrastructure needs while simultaneously recycling plastics. Feeta.pk features an in-depth analysis of plastic roads and their impact.

Adverse Effects of Plastics

Before delving into how plastic roads will help, it is essential to first understand how plastics harm the environment. Plastics are responsible for a considerable portion of the world’s overall carbon footprint. Since plastics cannot decompose, they are either recycled, incinerated, or discarded.