In Pakistan HBFC Home Loans, becoming a homeowner is a dream for many. However, the country’s soaring real estate market has made it impossible for many to achieve this dream, especially for the lower- and middle-income classes. If the current trends continue, these groups will be excluded entirely from the market.

To tackle this issue, the government of Pakistan launched a home financing initiative known as the Home Building Finance Company (HBFC), with the sole purpose of providing easy-installment home loans. The company continues to help those wanting to become homeowners through its financial assistance programs.

For those that want to know more about how to avail of these loans, Feeta.pk features everything you need to know about HBFC home loans.

A little about the Company

Established in 1952, House Building Finance Company (HBFC) is the country’s only real estate financing institution. With regional offices and area branches spread all over Pakistan, the institution aims at providing financial assistance to every Pakistani struggling with housing needs.

Over the years, the company has launched several programs to provide affordable housing to the lower- and middle-income classes. Programs such as ‘Ghar Pakistan’ and ‘Ghar Aasan Flexi’ allowed millions of Pakistanis to become homeowners with minimal debt.

Currently, the company’s objective is to reduce the demand and supply gap of residential units in the country, allowing the majority of the masses to own a home.

HBFC Home Loans

Despite majorly targeting the middle- and lower-income groups in the country, HBFC home loans are also available for almost all individuals that need some sort of financial assistance in closing the deal. Currently, the company offers three types of loans to its clients.

- Purchase of House or Flat

- House Construction

- Balance Transfer

These loans have extended to livestock owners, farm owners, and non-resident Pakistanis. These flexible payment solutions aim to assist anyone in Pakistan that requires finances for their housing needs.

Who is Eligible for an HBFC home loan?

Since the program’s primary objective is to facilitate lower and middle-income groups, a strict eligibility criterion has been set. To be eligible for the ‘Ghar Pakistan Scheme’, your monthly income should be below 100,000 PKR, while the ‘Ghar Pakistan Scheme Plus’ requires a monthly income below 175,000 PKR.

Affluent individuals can also apply for a home loan through the ‘Ghar Sahulat Scheme’. However, these loans offer higher interest rates since the target audience of these loans are the lower-income groups.

Moreover, those applying for the HBFC home loans must be salaried individuals, self-employed business owners, and self-employed professionals. For verification purposes, HBFC requires a one-year bank statement, monthly utility bills, and a salary slip.

How to Apply for an HBFC Home Loan

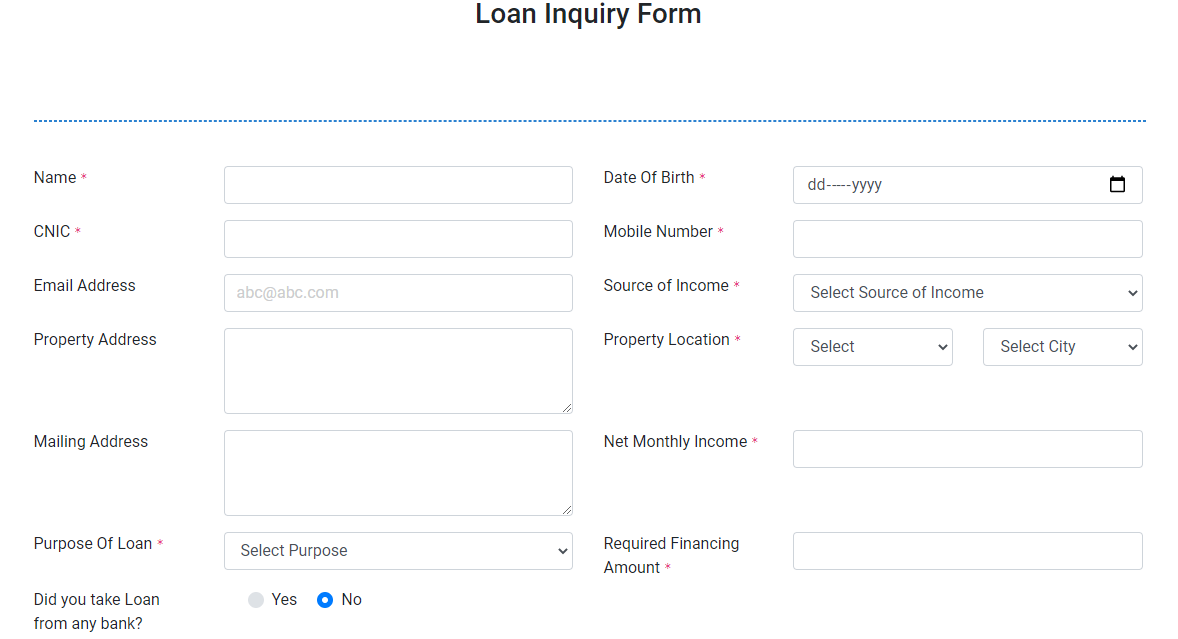

Source: HBFC

If you are unfamiliar with the application process for an HBFC home loan, simply follow the instructions below.

- Head over to the HBFC home loans website at hbfc.com.pk.

- Click on the ‘loan inquiry form’ option. This will take you to the next webpage, where you will need to enter your details and other credentials.

- Once the inquiry form has been submitted, the company loan agent will review the application and contact you within two to three working days.

- During the screening process, you can check your loan status on the company’s website at any time.

- After an initial screening of your inquiry, you will need to submit an application with the required documents and other processing fees.

- The next step involves filing a few legal documents for financing and security purposes.

- If approved, the loan amount will immediately be disbursed as decided in the terms and conditions of the agreement.

Pakistan’s real estate market is set to exclude middle- and lower-income groups, making it impossible for them to become homeowners. HBFC home loans aim to combat this exponential increase in prices by providing low-interest home loans with easy installments. For more information, visit Feeta.pk, Pakistan’s first online real estate market.